are funeral expenses tax deductible in australia

While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the expense on the federal tax form.

Pdf Taxing Popularity The Story Of Taxation In Australia

This means that you cannot deduct the cost of a funeral from your individual tax returns.

. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. Qualified medical expenses include. When a person dies generally the person responsible for administering the deceased estate is the legal personal representative.

The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. They are never deductible if they are paid by an individual taxpayer. In short these expenses are not eligible to be claimed on a 1040 tax form.

Funeral expenses - If you paid for funeral expenses during the tax year you may wonder whether you can deduct these costs on your federal income tax return. Funeral expenses are not tax-deductible. No never can funeral expenses be claimed on taxes as a deduction.

June 3 2019 1228 PM. This person may be an executor or administrator who has been granted probate or letters of administration by a court. This cost is only tax-deductible when paid for by an estate.

While individuals cannot deduct funeral expenses eligible estates may be able to. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. The estate itself must also be large enough to accrue tax liability in order to claim the deduction.

As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible. If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. A funeral service expense like the cost of coffins or hearses the cost of flowers cremations and memorializations is deductible.

Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. This means that you can not deduct the cost of a funeral from your individual tax returns. This means that you cannot deduct the cost of a funeral from your individual tax returns.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. The Australian Taxation Office ATO advises that personal life insurance premiums are not tax deductible¹. However if you have a group life insurance policy cover held through a superannuation fund the rules are slightly different.

In this case your fund pays a third-party provider for life insurance on your behalf. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. Many estates do not actually use this deduction since most estates are less than the amount that is taxable.

Funeral expenses are not tax deductible because they are not qualified medical expenses. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. In other words funeral expenses are tax deductible if they are covered by an estate.

What Death Expenses Are Tax Deductible. When determining the amount to transport the body to a funeral the funeral expense is preceded by the actual cost to transport the person with that body. These are personal expenses and cannot be deducted.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

When it comes to funeral costs themselves including burial and other important areas the determining factor in whether tax deductions are available is the source of payment for these costs. Well go over these in our next section below. The IRS deducts qualified medical expenses.

There are no inheritance or estate taxes in Australia. Burial and funeral expenses however are a bit more complex. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes.

Can I deduct funeral expenses probate fees or fees to administer the estate. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses.

Deductible medical expenses may include but are not limited to the following. This means that you cannot deduct the cost of a funeral from your individual tax returns. Deducting funeral expenses as part of an estate.

As well as claims against the estates certain taxes and certain debts incurred since July 1 2005. According to IRS regulations most individuals will not qualify to claim a deduction for these expenses unless they paid for the funeral out of the funds of an estate. It is legal to deduct from the gross estate funeral expenses administration fees and any debts incurred by the estates administration Code Sec.

Reforming Tax Expenditures In Italy What Why And How In Imf Working Papers Volume 2014 Issue 007 2014

Are Funeral Costs Tax Deductible In Australia Ictsd Org

Are Funeral Costs Tax Deductible In Australia Ictsd Org

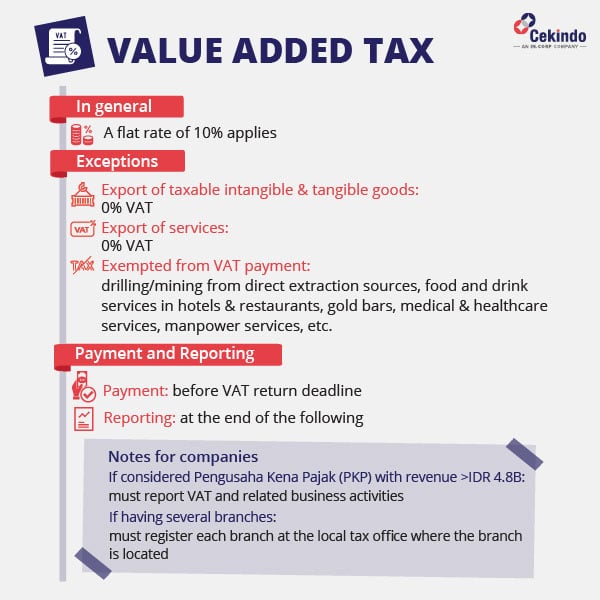

Indonesia Vat Everything You Need To Know About Value Added Tax

Pdf How To Achieve Tax Compliance By The Wealthy A Review Of The Literature And Agenda For Policy